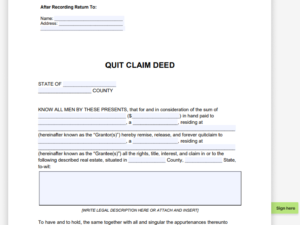

What is a Transfer on Death Deed Form?

DISCLAIMER:

Our contract templates are for general information only and not legal advice. Consult a legal professional to customize them for your needs. We’re not liable for errors or consequences from template use. They don’t replace legal advice; seek counsel for your specific situation.

5 Tips For Writing a Transfer on Death Deed Form

Here’s a list of steps on how to write a Transfer on Death Deed Form

- Download the Transfer on Death Deed Form.

Research the requirements for the state where the property is located. Many states mandate the use of state-specific forms or language for the deed to be considered valid. - Choose Your Beneficiary Wisely.

Decide whether you want to designate one person, multiple individuals, an organization, or a charity as your beneficiary. Provide specific details when listing beneficiaries; use full names instead of generic terms like “my children.” If selecting multiple beneficiaries, clarify how the property will be titled in their names, considering options like “Joint Tenants.” Be aware of your state’s recognition of such terms, as some may not accept certain designations. Additionally, consider naming an alternate beneficiary in case the primary one predeceases you. - Provide a Detailed Property Description.

Utilize the existing deed to copy an accurate description of the property. Cross-check the details against the original deed to ensure precision. - Sign the New Deed.

If you are the sole owner, your signature is likely sufficient. However, check whether you are in a community property state, as in such cases, your spouse may need to sign as well. - Record the Deed.

To validate the Transfer on Death (TOD) Deed, it must be recorded. Locate your Land Records office in the county where the property is situated. This office may go by various names such as County Recorder, Registrar of Deeds, or Land Registry. If unsure, contact your local courthouse for guidance on where to record real estate deeds.

Reviews

There are no reviews yet.